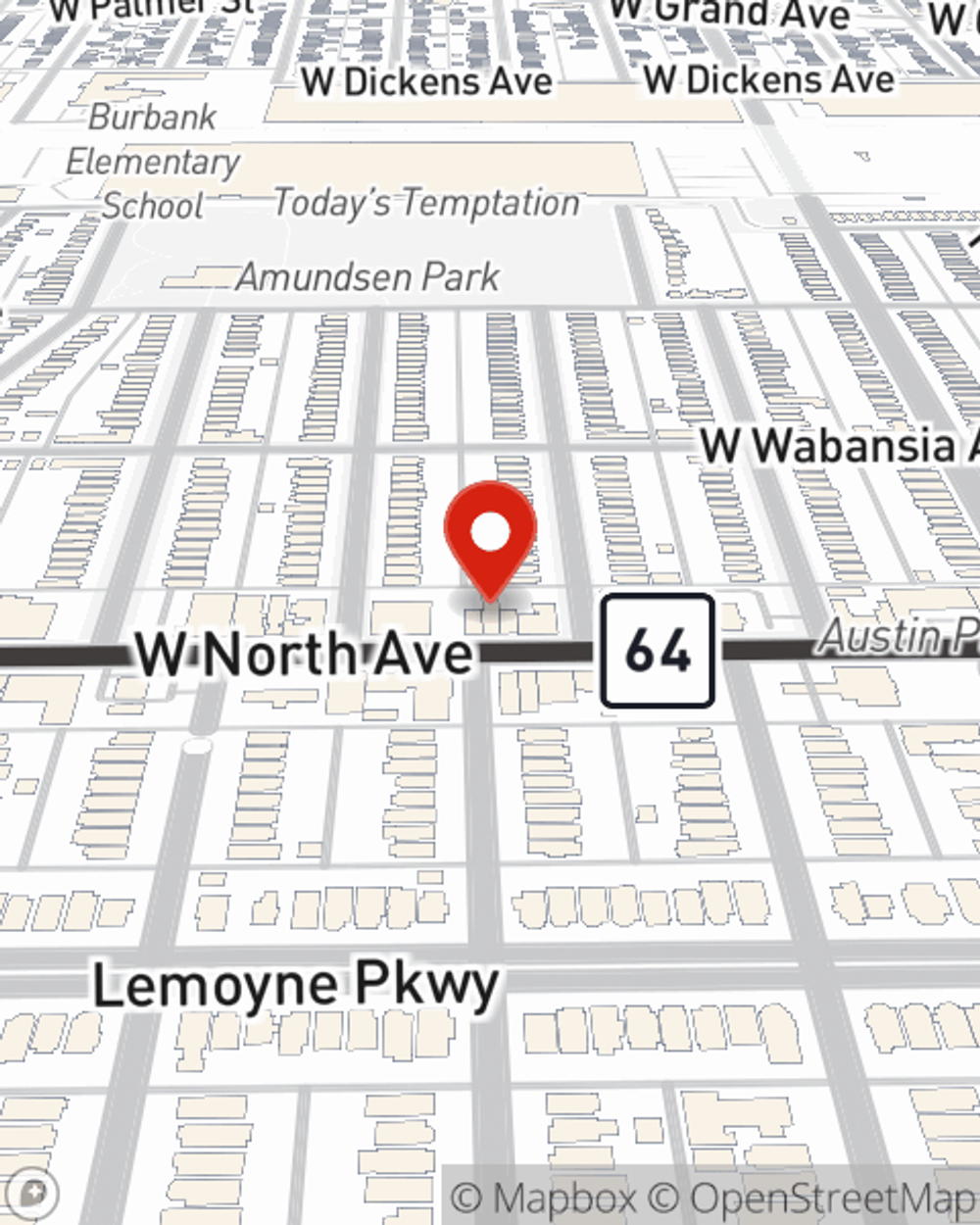

Business Insurance in and around Chicago

Researching insurance for your business? Search no further than State Farm agent Anthony Williams!

Cover all the bases for your small business

This Coverage Is Worth It.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected catastrophe or accident. And you also want to care for any staff and customers who become injured on your property.

Researching insurance for your business? Search no further than State Farm agent Anthony Williams!

Cover all the bases for your small business

Protect Your Future With State Farm

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like business continuity plans or extra liability, that can be molded to develop a personalized policy to fit your small business's needs. And when the unexpected does arise, agent Anthony Williams can also help you file your claim.

Take the next step of preparation and call or email State Farm agent Anthony Williams's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Anthony Williams

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.